It’s more than a little disconcerting that the United States Government seems indifferent toward a practical and workable solution to our current public debt situation. Perhaps the timetable isn’t what the public would like, but it is what The Market is now commanding.

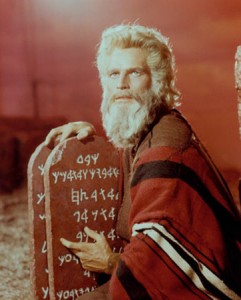

This pic was taken during one of Mr. Heston’s meditations with The Market. The tablets, translated loosely, read: “Pay down your debts, Charlton.”

Somewhere a long way from here, where it is blazingly torrid and parched, a man is staggering dazedly down a mountain slope. He’s been hit with a meteorite. The Market’s message to that guy was probably to do something about the debt issue, and to bring a GPS with him when he’s wandering around in strange lands…

There was a good editorial in the May 23 issue of Forbes by David Malpass. I hope you have better luck with the link than I am having. Their site, much like their magazine, has been wildly inconsistent for me. Here, at least, is a semi-serious starting point of conversation regarding the tipping point of the nation. I agree with Mr. Malpass—we’re not there yet—but it could happen with continued disregard of some rather serious issues.

One is the debt to GDP issue. If the damned Forbes link above would work, you could read about it. Or…If you have the misfortune of being a subscriber, you have probably already read it. I haven’t even cracked my Weekend Journal yet, and this is the treatment… Figures range generally from 79-90% debt to GDP as a point of very serious concern, and it appears the United States is diligently stomping its way into the mid-eighties within a few years. The US appears to be well-positioned to handle such nonsense with a bit of responsible management. Japan has demonstrated it is possible through sound asset management. We’ll see if this happens at home.